The International Monetary Fund (IMF) has observed that Zambia’s ballooning external debt puts the country at high risk of debt distress.

And the IMF says although the near-term outlook for the Zambian economy has improved in recent months, the country’s fiscal imbalance has remained very high.

In a statement published on the IMF website yesterday, the Fund’s directors who visited Zambia recently noted that the country needed to slow down on borrowing.

Below is the full statement.

On October 6, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation [1] with Zambia.

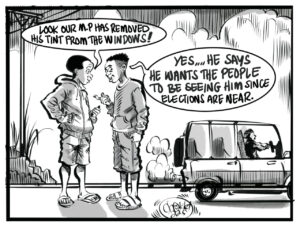

The near-term outlook for the Zambian economy has improved in recent months, driven by good rains and rising world copper price. The economy was in near-crisis from the fourth quarter of 2015 through most of 2016, reflecting the impacts of exogenous shocks and lax fiscal policy in the lead up to general elections. Low copper prices reduced export earnings and government revenues, while poor rainfall in the catchment areas of hydro-power reservoirs led to a marked reduction in electricity generation and severe power rationing. A sharp depreciation of the kwacha fuelled inflation which rose from an annual rate of 7 percent in mid-2015 to nearly 23 percent in February 2016.

Tight monetary policy succeeded in stabilising the exchange rate and slowing down inflation to 6.3 percent in August 2017, but contributed to elevated stress in the financial system evidenced by a sharp rise in nonperforming loans and a plunge in the growth of credit to the private sector. Stress tests suggest that the banks are resilient to credit and liquidity pressures, but the financial system faces considerable risks, owing to high dependence on copper exports, rising public debt and funding pressures.

Fiscal imbalances have remained high. The fiscal deficit on a cash basis reached 9.3 percent of GDP in 2015, twice the budgeted level. On a commitment basis—taking into account accumulation of arrears and delays in paying VAT refunds—the deficit exceeded 12 percent of GDP in 2015, and remained elevated at about 9 percent of GDP in 2016. The deficit on a commitment basis is projected to decline significantly in 2017, but the cash deficit will remain elevated as the government clears arrears.

Public debt has been rising at an unsustainable pace and has crowded out lending to the private sector and increased the vulnerability of the economy. The outstanding public and publicly guaranteed debt rose sharply from 36 percent of GDP at end-2014 to 60 percent at end-2016, driven largely by external borrowing and the impact of exchange rate depreciation. Increased participation of foreign investors in the government securities market has eased the government’s financing constraint but has made the economy more vulnerable to swings in market sentiments and capital flow reversals.

The medium-term outlook for the economy is contingent on policies. Real GDP growth has picked up after a marked deceleration from 7.6 percent in 2012 to 2.9 percent in 2015. Growth is projected to reach 4 percent in 2017. However, achieving sustained high and inclusive growth requires a stable macroeconomic environment as well as policies and reforms to increase productivity, enhance competitiveness, strengthen human capital and support financial inclusion for small and medium scale enterprises. Domestic risks to the outlook include delayed fiscal adjustment which would continue to crowd out credit to private sector and entrench an unsustainable debt situation, and unfavorable weather conditions which would affect hydro power generation and agricultural output. External risks include tighter global financial conditions and volatility in the world copper price.

Executive Board Assessment [2]

Executive Directors welcomed the recent improvement in Zambia’s economic outlook. However, Directors noted that domestic and external risks pose significant challenges. They advised the authorities to take advantage of the current favourable conditions and implement decisive and prudent macroeconomic policies and reforms to place public finances and debt on a sustainable path, build international reserves, increase the economy’s resilience to shocks, and achieve higher and inclusive growth. In this regard, they welcomed the launch of the Economic Stabilisation and Growth Program and the Seventh National Development Plan.

Directors commended the authorities for taking strong measures to phase-out regressive fuel and electricity subsidies, and for scaling-up spending on social protection programs. At the same time, they noted that achieving the government’s fiscal consolidation goals will require stronger efforts to increase domestic revenues, including by addressing widespread exemptions and broadening the VAT and income tax bases. Directors emphasised the importance of containing recurrent spending, improving commitment controls, phasing out subsidies, and strengthening public financial management.

Directors expressed concern at the pace at which public debt, especially external debt, has increased and now put Zambia at high risk of debt distress. They commended the progress made in developing a medium-term debt strategy. While recognising the need to address infrastructure gaps, they emphasised that to maintain debt sustainability, it is critical to slow down on the contraction of new debt, especially non-concessional loans, strengthen debt management capacity, and improve project appraisal and selection processes.

Directors welcomed the recent easing of monetary policy. They commended the Bank of Zambia (BoZ) for unwinding the quantitative and administrative measures it had used to tighten monetary conditions. Directors underscored that greater reliance on interest rates and market mechanisms would enhance the transparency and effectiveness of monetary policy. They stressed that credible fiscal consolidation is necessary to sustain the current monetary policy stance.

Directors emphasized the importance of safeguarding financial stability. They welcomed BoZ’s positive response to implementing the Financial Sector Assessment Program (FSAP) recommendations, including taking steps to strengthen supervision capacity and the crisis preparedness framework. Directors endorsed BoZ’s plans to complete on-site inspection of all banks within 12–18 months, and advised the BoZ to take action to address weaknesses that may be revealed. Directors encouraged the authorities to accelerate the process of revamping the BoZ Act, to give the central bank more operational autonomy while enhancing its transparency and accountability.

Directors emphasised that macroeconomic stability, policy consistency, and investment in human capital are critical to addressing Zambia’s high rates of poverty and income inequality and promoting sustainable growth. They encouraged the authorities to address policy uncertainties that are clouding the investment climate, including clarifying the roles of the state and the private sector in the energy and agriculture sectors.