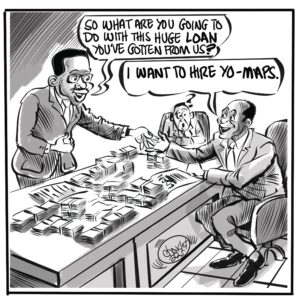

Zambia Development Agency (ZDA) acting Director-General Matongo Matamwandi says Zambia attracted US $5 billion worth of investment pledges in the second quarter of 2019 and that close to 60 per cent of the amount is in the energy sector.

Speaking when he featured on ZNBC Sunday Interview, Matamwandi explained that there had been a lot of investors wanting to go into the energy sector due to load shedding and the power deficit, which the country was still grappling with.

“That figure represents cumulatively up to end of June going into July. From all the investment activities that we have undertaken, this is how much we have attracted, into investors coming, setting up their businesses and the projects that if actualized, they are able to give us that US $5 billion-plus. Close to 60 per cent of that is in the energy sector and I think for the obvious reason (that) information goes around on these issues around the energy deficit and load shedding and proper people don’t see a problem on that, but they see an opportunity. We have seen a lot of interest in investors wanting to go into the energy sector. Interestingly, you find that all the registered investors (that) we have in the energy sector, none of them are traders. They are looking at how they can generate power so that they can supplement what we have. By this situation, we should be seeing more results by next year going into 2022. By 2022, we should be able to be talking about a lot more energy coming out; clean energy like solar, wind and so on,” Matamwandi said.

He said that the Agency only announced investment projections once interested companies had done all the paperwork registration of their businesses in the country.

“We only announce the figures when we know that the businesses have been set, they have found premises and they have started actualizing. People need to understand that big projects cannot be done overnight. If a business comes, registers the business with PACRA, comes and gets an investment certificate; registers with NAPSA and ZRA and we give them a certificate, at that point when they tell you that this project is going to cost 2, 3, or 5 or 10 million dollars, we announce it because we have assessed and done all the groundwork. That doesn’t mean that the US $10 million, which they are talking about in the next two months is going to be put and the project is done. A cement plant could take two and half years or even three years. So, when we say this is what has been pledged, in fact, we call them projections, at that stage we announce,” he added.

He revealed that the manufacturing industry had also attracted a good number of investment pledges.

“We have seen a lot of interest in companies that are coming to say ‘look, you are producing a number of agricultural products, but primary agriculture, we want to if we can do agro-processing. We have seen those who want to do drinks from mangos and other fruits. We have seen those who want to do ethanol from cassava and also we have seen some who have come to say ‘look, we should consider producing some of the little spare parts that are imported, especially for the mining side. So, manufacturing looks like another one, which is attracting a lot of investors. But, obviously, there are challenges; you can only manufacture if the market is there. Zambia is a country with 17 million people. Demand creates its own supply. If there is no consumption, then there is no market,” he explained.

Asked why there was still an eroded investor confidence mainly attributed to the power deficit and political interference, Matamwandi claimed that the Agency was not aware of such a scenario.

“If there is a genuine loss of investor confidence as a result of a given reason, it’s not being reflected in what we have on our side. They have raised issues, of course, but believe you me, there are even investors who go in countries like in the DRC. Now, with all the pieces and politics going on here, investors don’t just get scared. They will come and verify and validate. Even if they see certain things on social media, these are serious people,” replied Matamwandi.

And asked why the focus was more inclined on recording figures from Foreign Direct Investment (FDIs) and less on promoting local industries, he responded saying:

“If anything, you will be interested to know that we put more resources in promoting the growth of SMEs than we do on FDIs.”