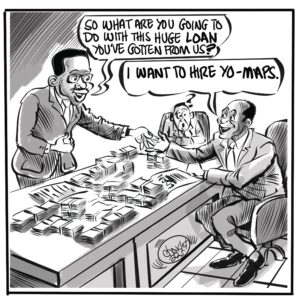

ZANACO Plc has posted increased operating income of over K2.3 billion during its financial year period ending December 31, 2020, mainly boosted by higher returns from lending, which grew by 53 per cent.

In a statement, Zanaco announced that the group’s operating income during its financial year period ending December 31, leaped to K2.37 billion last year, up from around K1.54 billion in the corresponding period in 2019, representing a 54 per cent increase, triggered by an astounding 53 per cent increase in income earned from loans and advances, among others.

At bank-level, Zanaco posted K2.36 billion during the period under review, up from K1.539 billion during the prior period, equally representing a 54 per cent increment.

“The Group’s performance continued on a strong growth trajectory. Total operating income increased by 54 per cent from K1,543 million in 2019 to K2,373 million in 2020 primarily due to increase in trading income and interest income from loans and advances. Trading income grew by 133 per cent compared to prior year on account of increased volumes of transactions as well as an improved product mix off ering. Interest income from loans and advances increased by 53 per cent from 2019. This is refl ective of the growth in the loan book, which grew by 52 per cent from K4,817 million in 2019 to K7,328 million in 2020,” Zanaco stated in its audited results.

It achieved a strong balance sheet growth, with total assets skyrocketing to a value of over K19.3 billion last year, while customer deposits swelled to nearly K16 billion during the period under review.

“The Group achieved strong balance sheet growth with total assets at K19,340 million, a growth of 63 per cent from prior year. Customer deposits grew to K15,698 million from K9,848 million, representing a 59 per cent increase. This is in line with the Group’s strategy of aggressively growing deposits necessary to increase funds available for investments. The credit risk processes continued to be improved whilst carefully growing the loan book to support our customers,” it stated.

However, the bank revealed that the kwacha’s steep depreciation negatively impacted its operational costs last year.

“Operational costs were adversely impacted by the depreciation of the kwacha and inflationary changes, which resulted in an increase of 33 per cent compared to prior year. The Group continued to invest in its strategic initiatives, which saw an increase in transformation costs from K52 million in the prior year to K209 million,” stated Zanaco, whose profits attributable to shareholders also jumped to over K206 million at group-level last year, up from K200 million in 2019.