Renowned economist Professor Oliver Saasa says his several attempts to reach out to President Edgar Lungu and render professional advice on how to fix the country’s economic crisis have failed.

And Professor Saasa says domestic factors such as the challenges being faced in the mining sector and the bad economic situation have contributed to the Kwacha’s depreciation.

In an interview, Prof Saasa said he had on many occasions tried to seek audience with President Lungu to render professional advice, but that all his attempts have failed.

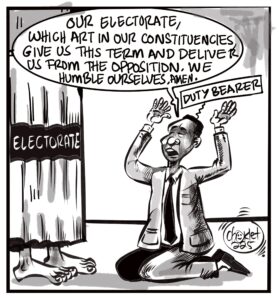

He noted that government’s failure to listen to professional advice on economic issues also contributed to the rapidly deteriorating economic situation that led to the depreciation of the local currency, adding that only those who flatter politicians were given audience.

“Government needs to listen to professionals; I am not seeing this now. Professionals are fighting to have their voices heard and they are called names for telling them that ‘let’s not go this way.’ And I can see government listening to people that sound more sympathetic to their views, but they are not admitting that we have a crisis that needs to be addressed. The President, sometimes, seems to be listening a little bit more to people that are telling him that ‘things are well’ when professionals know that things are not well. We have to listen to each other and for me, this is the bottom line. And no one is playing politics here, especially professionals, there are not many of us who want to be politicians; we describe things as they are. But because my view may coincide with the view of a political party, it does not mean I am following them; my views are not influenced by any politician,” Prof Saasa explained.

He said those in government had a tendency of aligning professionals to opposition political parties whenever they speak differently from their views.

“We must leave the time for praise singing because politicians like to be told that ‘you are a great guy,’ I don’t think that’s what we need right now. I interact with ministers, these are colleagues. The only person that I have tried to seek audience with and I have failed lamentably, is the President, and even using some ministers. When Felix Mutati was the Minister of Finance, every month, I was [having] a private meeting with him where I would share my advice on economic issues. I have opened my door to the current Minister of Finance (Margaret Mwanakatwe); I have offered to talk to her when the IMF came here; she called me and said: ‘no, let’s meet, even before you meet them so that we compare notes.’ I said: ‘please, my door is open,’ she didn’t facilitate that meeting,” he disclosed.

“We have to have a system that allows people in government to meet technocrats; not only when there is a crisis, but even when things are fine, you just call them to appreciate them for helping when things were tough, but that does not happen here in Zambia. There are no think tanks that link with government except those that are looking for jobs, and you know who. But they believe that anybody who speaks differently from what they are thinking is a member of the opposition! I don’t even know where the secretariat of the UPND is, I don’t even know where the PF secretariat is. I am not a politician, when I join politics I will announce, the whole world will know.”

And Prof Saasa, the Premier Consult Limited chief executive officer, observed that the Kwacha’s depreciation was due to a combination of internal and external factors such as the challenges in the mining sector.

“There are a number of factors; there are domestic and external factors that have led to the depreciation of the Kwacha. The behaviour of the Kwacha is very much influenced by what is happening within the economy in terms of the status of the economy and the attractiveness of the economy to investors because the Kwacha’s value is dependent on how attractive the economy is, and how attractive the Kwacha itself is, relative to other currencies. We had Treasury Bills or bonds that are open and ready on the market, but how many investors come into the country and buy these Treasury Bills or bonds, will be dependent on what they believe and to what extent the economy is growing and they are going to yield better returns on that investment. So, if there are factors that are making the local investment environment not attractive, then it will be difficult to attract investment that would see more money come into the economy. Externally, most of our external deals are transacted in the American dollar, so if there is appreciation of the American dollar, it means that the relative value of the Kwacha to the dollar will also be reduced because the dollar will be expensive,” explained Prof Saasa.

“So, what is the current performance of the economy especially in terms of export receipts? The major supplier of foreign exchange is the mining sector. Right now, the mining sector is not decided; you have seen what’s happening. They have decided that because of the impasse they are having with the government over tax, the (2019 mining) fiscal regime, they are not ready to and willing to invest. What it means there is that there will be less investment from the major source of the foreign exchange revenue. Just that is sufficient to influence the views of those investors planning to come to Zambia to look at the country as not being a serious investment destination. It is also known, globally, that the Zambian economy decided to change the fiscal regime to now pick much more than what they were picking because we are stressed. Of course the government must raise money but how they raise it matters, the speed at which they raise it matters, the extent to which when they raise it, it causes other problems elsewhere, it also matters. So it means that any stress in the mining sector; whether the government is right or wrong, it doesn’t matter, it creates a market perception that the Zambian economic environment is not suitable to the mining sector. And they are not sparing anyone to really demonstrate to the world that Zambians are bad, especially when we are failing to pay their VAT refunds. So, when that information goes there, those who are supposed to bring more dollars in the economy, including the mining reinvestment, it will lead to the reduction of dollar (inflows). There will be more demand against the few dollars available on the market.”