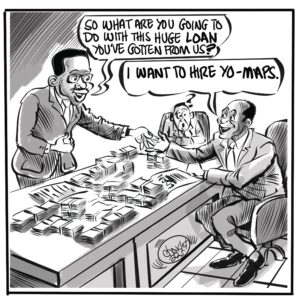

MUCH talk and discussion has been held about Zambia needing to clinch an economic bailout package with the International Monetary Fund (IMF) in recent years. But this elusive economic programme seems to be a dream that President Edgar Lungu’s government will never see materialise into reality, mainly on account of Zambia’s insatiable appetite for reckless borrowing and failure to account for existing loans.

We have demonstrated in previous editorials how much cash this administration has borrowed from a cocktail of both concessional and non-concessional lenders, and how our leaders have failed to account for these funds. Up to now, we’re still trying to figure out where the entire US $3 billion worth of Eurobond proceeds went, or how Zambia Railways Limited, Zesco Limited, among other parastatals, utilised their shares of the proceeds to give Zambians full value for their money.

The Zambian government has been locked in endless, tedious talks with the Fund since President Lungu first assumed office back in January, 2015, and so far, we have had four Ministers of Finance who have flown back and forth for the Fund’s Annual Meetings, but the country is still nowhere near clinching a bailout deal expected to be in the region of US $1.3 billion for Balance of Payment support.

Last Wednesday, Bank of Zambia (BoZ) governor Dr Denny Kalyalya told journalists that Zambia may never get on an IMF economic programme due to the country’s unsustainable debt levels, which he said, was unfair.

“Go to the IMF website, check on low income countries and the facilities that are available. All IMF facilities have conditions that they can only provide support to a country which has a sustainable debt situation, or at least it must have a credible plan that will bring that to sustainable level. Those are the conditions, I am not dreaming them up, they are there. So, that’s the challenge we have… If the IMF doesn’t endorse that the macro framework that we have is good enough, they will not proceed to provide Balance of Payment support, equally, the AfDB will not. But these are rules, which we set, which are very unfair! And you see, one would have thought that when a country is in problems, that’s when actually you get assistance. Unfortunately, that’s not how international financial architecture works; you are expected to be strong enough so that the support that you are being given is used for the purpose for which you have got it,” said Dr Kalyalya.

At face value, we agree with Bank of Zambia Governor’s assessment when he laments that unfair rules are making it difficult for developing countries to benefit from the Fund despite being members of this multilateral institution. He is also right to say that countries that are in problems need help the most. The COVID-19 pandemic is one such problem that the IMF could consider bending their rules for because it is not a Zambian problem. In this regard, we agree with Professor Oliver Saasa who says there are other ways in which institutions such as the IMF can help specifically in the fight against the Coronavirus without going through the government Treasury if they are concerned about abuse of funds. It’s unfair for the IMF to deny us that help because it’s not of our own making; it should be treated as a global problem. By denying Zambia COVID support, the IMF is condemning every citizen of this country and branding us all reckless and undeserving, which is very unfair.

But when it comes to the traditional IMF Balance of Payment support, Governor Kalyalya pointed out a very key point in his explanation of the need for African economies to be strong enough so that the support that countries are being given is used for the intended purpose. Part of Governor Kalyalya’s statement took into consideration our lack of seriousness, as African governments, to account for public funds in order to gain the respect and trust of these important institutions to access the badly-needed financial assistance in the first place. We, therefore, must improve our systems of accountability and strengthen all governance institutions that provide critical oversight, such as Parliament, the Financial Intelligence Centre (FIC) and the Auditor General’s Office.

If Zambia did not over-borrow, the Treasury would not be as stressed as it is today. The billions we are paying back to international shylocks would have been channeled towards emergency funding for programmes like the COVID-19 pandemic. It is unfortunate that we have to kneel down and plead with the IMF to help us out when we have been spending money recklessly on unproductive projects and losing millions of dollars through illicit financial transactions. There is no dignity in begging. We can’t boast of sovereignty when our survival is at the mercy of multilateral institutions.