ECONOMIST Professor Oliver Saasa has cautioned government not to proceed with its intention to take over Mopani Copper Mines, saying the move could render the mining company commercially unviable due to possible excessive political interference.

And Prof Saasa says that the proposed take over where government, through ZCCM-IH, plans to buy out Glencore’s 90 per cent shareholding, is tantamount to expropriation, which may not achieve its intended objectives of safeguarding jobs.

In an interview, Prof Saasa argued that government’s proposed take over of Mopani at this point was ill-advised as its fiscal position remained stressed, induced by COVID-19, among other factors.

“First of all, on a personal-level and my experience from where we are coming from and at the time we were running mines; the reason for justification to why we had to privatise them, and the general behaviour of governments worldwide that manage mines, big conglomerates and given the circumstances the world finds itself, including Zambia, in terms of fiscal stress that has been introduced by a number of things among which is COVID-19…This is not the time that government can consider raising resources to procure and begin to run at that level of investment of about 90 per cent of shareholding,” Prof Saasa said.

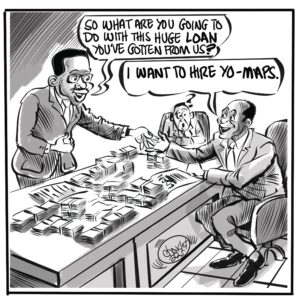

“If the company fails to make the grade and then you go deep into the Treasury, tax payers’ money, you start subsidising them, then you are failing one important canon about level-playing field because you are advantaging them against the others and, therefore, you are beginning to affect the level-playing field. Immediately you start giving big subsidies to a company, you start accumulating the manager’s belief: ‘we can do whatever we want, our shareholders, which is government being sovereign, have the money, they can borrow and they will come to our aid.’ The dynamism of management to take proper corporate decisions would always be questionable because they know there is the ‘big brother’ in the background. That in itself makes a company that is owned by the government and unduly controlled and influenced by government in political decisions to be uncompetitive and unviable.”

And Prof Saasa, who is also Premier Consult chief executive officer, said that the proposed take over was tantamount to expropriation.

What is important is not really ownership, what is important is to have a company that runs a mine better and the government will get its tax from there rather than Ministries trying to interfere in the management of the mine. You have to be extremely careful how far you think that you are competent as a country to allow politicians to be influencing corporate decisions. I will be the last one to advise the government to get a 90 per cent stake unless it’s temporary while you are looking for a partner. Even then, the question is, why are we failing to reach an agreement with Mopani shareholders? What exactly has happened? Those companies were stressed, they said they were putting these on care and maintenance, they didn’t say, ‘we are shutting down.’ But we reacted and now we are saying, ‘we expropriate?’ That is as good as expropriation, 90 per cent is as good 100 per cent. The bottom line is, government really needs to think twice before you make a mistake. We will learn to regret as we regretted during Kaunda’s time,” Prof Saasa said.

“My advice to government, please think and think very carefully because in the short-term, you may believe that this is in the best interest of the workers; in the medium to long-term, from our own experience, we get 90 per cent under the circumstances, is inappropriate. It doesn’t mean the government shouldn’t have shares in the mine no, we can have shares. We can open our own mines if we want. But the whole idea is if government starts a mine, try to the extent possible to dilute government interests. Bring the private sector because in most cases, it is not the business of government to run business because governments are bureaucracies, businesses are not bureacies, business is actually based on the decisions that are made on corporate decision-making.”

He questioned how government would not interfere in Mopani’s operations when senior officials sat as the board of directors in ZCCM-IH.

“ZCCM-IH is a holding company that takes stakes in companies. ZCCM-IH is a government investment arm, so when you say, ‘there won’t be interference, you can say that, but how can you assure that when you see the composition of the board? During Kaunda’s time, the president of Zambia was chairman of Indeco, which was a holding company and the transgressions that were committed there are there for anyone, who is interested in the mines and how we collapsed and how we had to privatise. For me, if government gets 90 per cent in Mopani, that is nationalisation. Can we trust the political system, even if they say, ‘we will not interfere to manage those mines,’ let us give government 90 per cent shares and give them five years and let us start talking again. Everything I am saying here leaning from the experience of Zambia will come back to haunt us. Let us learn from our past errors,” Prof Saasa cautioned.

“Everything I have described to you is exactly what happened during the Kaunda period when government was owning substantial shares in the mining houses. What I am seeing now is actually a repeat of what was happening during the Kaunda period. If you recall, I am the person who questioned the creation of IDC because it was more like a return to the Kaunda era. Immediately, that holding company is chaired by the Head of State. Now, who are the other board members? It could be Permanent Secretaries, Directors, who were directly appointed by him in that portfolio. What is going to happen? You can imagine the corporate decision-making; the corporate laws of Zambia require that if a company defaults at some level and makes a blunder, the board members are answerable. How do you have a situation where the chairperson of that corporation has immunity? I am not talking about President Lungu, I am talking about the Presidency. I would say this in yester years, I would say this in the next governments that would come into this country.”

He added that political interference would affect the corporate decision-making of the mine.

“Even if it was the right time, meaning that the economy was fairly vibrant and ZCCM-IH had sufficient resources to buy, there are a number considerations that government opt to reflect upon. Firstly, one has to accept that shareholding, what makes a company profitable or non-profitable is not necessarily who owns it. A government can own shares in a company, what makes the difference is not the ownership to a large degree, although there can be issues there; what makes the difference between private-owned and government-owned companies is corporate autonomy that is extended to those that are managing those mines. Immediately, you have a situation where there is political interference,” observed Prof Saasa.

“Political interference, by the way, it is not like you are interfering in the negative, but that you are making corporate decisions as if it is a bureaucracy and you are allowing political considerations. That may be justified under certain circumstances to colour the decisions regarding how much you invest when you invest, with who you are investing. Immediately you allow political considerations to influence the corporate decisions regarding the management and investment of the company, then you have painted its capacity to run efficiently and profitably.”

Glencore Plc is facilitating the offloading of 90 per cent shareholding in Mopani to ZCCM-IH, according to Mines Minister Richard Musukwa, who also told Diamond TV, Sunday, that this followed a submission by ZCCM-IH to increase its shareholding in Mopani.

The Swiss-based commodity and mining company had earlier this year announced its intention to place Mopani on care and maintenance, signalling its desire to exit the Zambian mining sector amid its huge operational costs.