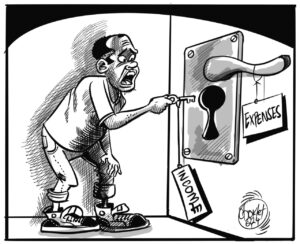

Bank of Zambia (BoZ) Governor Dr Denny Kalyalya has announced a reduction in the monetary policy rate in an attempt to boost lending and ease the economic pressure the country is facing as a result of lack of liquidity.

And Dr Kalyalya says economic activity in the first quarter was low due to electricity deficits which affected production in some sectors such as mining, construction, manufacturing and agriculture.

In a Monetary Policy Committee statement delivered at a media briefing today, Dr Kalyalya said BoZ reduced the Policy rate after taking into account the drop of inflation.

“The Monetary Policy Committee (MPC), at its meeting on 15th and 16th May, 2017, decided to reduce the policy rate by 150 basis points to 12.5 per cent from 14 per cent and the Statutory Reserve Ratio by 300 basis points to 12.5 per cent from 15.5 per cent. In arriving at this decision, the committee noted that annual inflation closed the quarter at 6.7 per cent, down from the end-fourth quarter 2016 outturn of 7.5 per cent. Inflation in April was 6.7 per cent and current forecasts indicate that it will remain well anchored within the target range of 6-8 per cent over the medium term. Economic activity remained subdued in the first quarter of 2017,” Dr Kalyalya said.

“Credit to the private sector contracted contracted further despite an increase in money supply. Although yield rates on government securities declined, lending rates remained high. Recent measures taken to address subsidies in the energy sector, combined with revenue enhancing measures, are critical to reducing the overall budget deficit and are broadly in line with the fiscal consolidation efforts…the Bank of Zambia will closely monitor domestic and external developments and stands ready to take appropriate monetary policy measures to maintain price and financial system stability and ultimately support diversification.”

He said Commercial banks’ lending rates had declined.

“Commercial banks’ nominal lending rates declined marginally to 28.8% in March 2017 after peaking at 29.2% in December 2016. The range between lowest and highest lending rates narrowed to 10.0%-38.5% in March 2017 from 10.0%-41.0% in December 2016. the relatively high lending rates reflected in part commercial banks’ response to rising non-performing loans, higher returns on investment in government securities, and lagged response to movements in short term money markets rates and inflation. Improved liquidity conditions drove down interest rates for negotiated deposits, ranging from 11.0% to 31.0% in March 2017 compared to the December 2016 rates, which ranged from 18.5% to 36.0%. The average 180 day deposit rate for amounts exceeding K20,000 also declined, albeit marginally to 11.6% from 12.6% over the same period,” Dr Kalyalya said.

“Total domestic credit expanded by 6.5% to 52.1 billion during the quarter under review compared to the growth of 1.1% in the previous quarter. This was driven by lending to government, which increased by 18.1%. in contrast, credit to the private sector contracted further by 3.2% relative to 5.4% in the last quarter of 2016.”

And Dr Kalyalya said domestic economic activity was low in the first quarter.

“For the quarter under review, available real sector data indicates that economic activity generally declined. Seasonal factors affected production in some sectors such as mining, construction, manufacturing and agriculture. In addition, most sectors continued to experience limited access to credit mainly due to banks’ preference for government securities, high lending rates, and prohibitive collateral requirements. However, electricity generation, which is virtually all hydro based, picked up as water levels in the reservoirs improved following above normal rainfall during the 2016/17 rainy season,” Dr Kalyalya said, also noting that there had been improvements in the global economy.

“The current account deficit narrowed to US$257.1 million in the first quarter of 2017 from US$574.7 million in the last quarter of 2016 due to improvements in the trade and primary income account balances. Total export earnings rose by 22.2% to US$2, 236.0 million while imports grew by 15.4% to US$2,196.5 million. The primary account balance improved to negative US$169.3 million from negative US$379.8 million. The deficit was financed by a surplus on the financial account with gross international reserves remaining little changed. Gross international reserves closed the quarter at approximately US$2.3 billion, representing 3.2 months of import cover, same as in the previous quarter.”

He said over the next two years, growth of the GDP was expected to emanate from agriculture, mining, manufacturing, recovery in energy and construction, accommodation and food services (tourism).

Meanwhile, Dr Kalyalya said GDP growth for 2017 and 2018 was projected at 3.9% and 4.6%, respectively.

“The current forecasts indicate that inflation will remain within the target range of 6-8% over the medium term. This takes into account the recent upward adjustment in electricity tariffs. Moreover, risks to inflation are, on balance, currently assessed to favour low and stable inflation. The announced bumper maize harvest during the 2016/17 farming season, and the sustain implementation of fiscal sustainability measures are some of the domestic factors supporting the favorable inflation projection. The recovery in global growth and commodity prices should help support export growth and relative stability of the exchange rate of the kwacha against the U.S. dollar,” said Dr Kalyalya.

“Over the medium-term, economic growth prospects are expected to improve with GDP growth for 2017 and 2018 projected at 3.9% and 4.6%, respectively. However, challenges to growth and the financial sector remain. These include high interest rates, low credit growth, rising non-performing loans and rigidities in the transmission mechanism of monetary policy.”