THE Public Service Management Division says there is nothing illegal about the debt swap initiative. According to PSMD Permanent Secretary Boniface Chimbwali, this project is meant to give some relief to highly indebted civil servants, a debt relief by providing flexible repayment plans for their loans.

Boniface CHIMBWALI: “If I owe you and you owe me and then we agree that we settle our debt, what is illegal about that? That is an agreement. Secondly, if I owe you and you owe a third party and you say ‘please PS [pay] on my behalf my nkongole (loan) to Mr X or madam X’, what is illegal about that arrangement? For me those are my two questions as a way of answering those questions. If someone can demonstrate to me that ‘look, government you owe your worker in terms of leave pay or settling-in allowances, don’t pay because it is unsustainable’. First of all, no one is saying if you owe, you will never pay nkongole. If it is us owing we pay, if it is the employee paying, they will pay, if the employee owes the other person, we will help them settle and we restructure the loan so that there is a breather.”

Our first argument is that this debt swap was not done in consultation with stakeholders. This is the reason why the Bankers Association of Zambia has distanced itself from it and warned civil servants that those who are owing commercial banks will pay what they owe unless the government settles the outstanding amounts in full. Now, how can you come up with a debt swap programme without first agreeing with other key financial institutions?

Secondly, if the so-called public service microfinance institutions are government owned, how much sense does it make to transfer the debt from one government institution to another? What we know is that government institutions depend on the central government for funding and operations, so if you ask the microfinance institutions to forgive the debt owed by civil servants, it means you are transferring that pressure to the Treasury.

In our view, the government is supposed to first conduct a survey to find out why civil servants contract all those loans. It is important to understand first which category of these employees are recklessly debt thirsty, and which government employees borrow for viable investments. This information is necessary for the government to treat the problem instead of the symptom. Borrowing is not a problem, but borrowing without a repayment plan is a symptom of a much bigger problem.

Many of our readers will agree with us when we say that a debtor must be allowed to choose his or her creditor. In the business of loans, owing Paul is not the same as owing Peter, even if the conditions are the same. There are creditors or institutions which people are not comfortable borrowing from. Some government workers are happier owing a microfinance institution or a bank than owing the government.

Some government workers are eager to pay back their loans in the shortest possible time so that they can return to their financial freedom. We don’t think such employees are interested in prolonging the repayment period of their loans. What the government needs to do for such employees is to simply pay their salaries on time. That’s all! Once salaries are paid on time, the institutions where loans were obtained will get their share and life will go on until the money owed is paid.

There are those government workers who are gifted with entrepreneurship. Once they find capital, they fly away with brilliant business ideas. These are civil servants who are able to borrow from banks or microfinance institutions and have no problems paying back. This group of civil servants don’t need a debt swap because it only complicates their financial planning. Entrepreneurs who work for the government hardly rely on their salary, so this relief that Mr Chimbwali is talking about is not helping anything really.

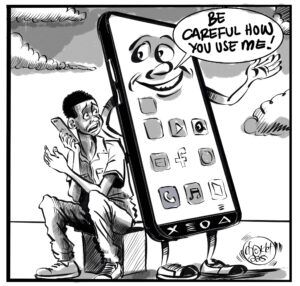

Then there is another type of civil servants who contract debt with no idea how to repay. Such civil servants need a different kind of help and not a debt swap. Giving the so-called debt relief to a civil servant who has an insatiable appetite for borrowing only creates more room for him or her to go back to the shylocks on the street to add more nkongole. Such are the kind of civil servants who cannot live within their means. When they see a friend driving a car, they get a loan so that they can also drive. When they see a workmate with an iPhone, they also want one.

Talking about failure to live within one’s means, the PF government fits perfectly into this category. As we can see already, instead of focusing on dismantling its own national debt with foreign creditors, they are busy showing sympathy to public servants. To many of us, this looks like a campaign gimmick, this is not a debt swap but a deduction freeze.