THE Centre for Trade Policy and Development (CTPD) says COVID-19 has not brought about new economic challenges in Zambia but it has only heightened already existing problems.

And the Consumer Unit Trust Society (CUTS) says government should consider reducing the income tax rates in order to mitigate the impact of the COVID-19 pandemic on households.

Meanwhile, the Jesuit Centre for Theological Reflection (JCTR) says the civil society organizations should work together and push government to be more transparent on debt.

Speaking during a virtual panel discussion, Tuesday, Ibrahim Kamara from CUTS said ordinary citizens were most affected by the effects of the COVID-19 pandemic because the cost of living has gone up while many of them were no longer in employment.

“In as much as the economy has been crippled, the ultimate people who suffer the most as a result of this COVID-19 are the [ordinary] people. It is important to analyze the impact of COVID-19 in those lines. COVID-19 has to a larger extent magnified the problems that we had as a country. Narrowing down to the extractive, we have seen a decline in revenues predominantly because Zambia is export oriented and the traditional export commodity is a mineral which we export to different countries abroad. When the global markets were shuttered, it became hard to export certain things and to export anything because the boarders were closed. China which was the epicenter for the COVID pandemic also could not export as the economy was crippled,” Kamara said.

“On one hand, of course, we have seen a decline in terms of foreign revenues and also the job market specifically in the extractive sector, we have seen a cut in jobs mainly because the COVID pandemic has brought in challenges and specifically people are unable to work. We have also seen a decline in productivity because some companies are unable to meet some of the cost and of course labor costs. The cost of living also is directly proportional to the prices in the country like if the exchange rate is bad, inflation is also high.”

Kamara highlighted some key economic sectors which had been most impacted by the pandemic.

“In terms of what we export as a country, we haven’t really done much. As others indicated, 70 per cent of our exports are raw materials. And of course we have seen challenges in the domestic sector. We have also seen the Ministry of Finance and specifically the Zambia Revenue Authority cutting down on the target for 2020 in terms of the resources that were budgeted for and this is mainly because of the forecast that has been put in for the economic growth. For the first time in so many years, economic growth is forecasted to go down into the negatives. And when growth goes in the negatives, then we are experiencing a recession as a country. And also in terms of the foreign exchange that you would expect to receive have been affected. In the tourism sector, planes would no longer fly when we were deep into the crisis. We get a lot of foreign exchange from the tourism sector but seeing that we could no longer sustain that, it also became a burden on the local people,” he said.

Kamara noted that the economy was already crippled before the pandemic.

“These are some of the challenges that have only been heightened by the pandemic. We cannot take away the fact that we could have responded well to this pandemic had we set in place certain mechanisms that we would have put as contingencies. For example, we would have looked at the amount of resources that we would have spared to respond to such a crisis and these are resources that have been wasted on debt servicing. These are our obligations of course I do understand but these are things that we have brought upon ourselves,” said Kamara.

And JCTR’s Innocent Ndashe said the some vulnerable people who were supposed to be on the social cash transfer scheme were not aware of the program hence the need for government to scale it up.

“A lot of people have been affected in different ways more especially the old ones. Businesses have complained that there is no business. Cost of living has gone up and households of course will have to compromise on the quality of means that they will take. Accommodation might be a problem especially in Lusaka where is rated at K3,000 minimum. And the Social Protection is a good program but it has to reach the people that it’s meant to serve. If resources allow, there is also need of scaling up the program beyond the current number that has been targeted and prioritizing those that have been heavily hit by the pandemic. And that calls for more accurate statistics. I think this is where the government needs to ensure that they have up to date statistics. But more importantly, players like research institutions, and the civil society organizations can try and help government get accurate statistics of how many citizens have been added to the numbers of the poor people benefiting from this scheme,” Ndashe said.

Ndashe said there is need to make the government more transparent on debt figures in order to clear people’s doubts.

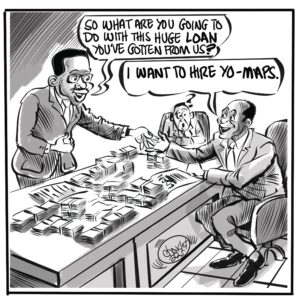

“We also need to engage the government and see how best we can make them become more transparent on the disputed figures of the current debt that the country has. If we are able to get the government accountable and if the government is able to become more accountable, even the other things like who do we owe and how much do we owe them will unfold,” Ndashe added.

“We also should be advocating for cancellation of debt, restructuring of debt and things like that. But also more importantly is pushing the government to be more accountable and putting mechanisms in place so that any freed resources should go to the areas where they are intended to go. Already, there have been concerns that some of the COVID-19 items in monitory form have gone to infrastructure development. Already, that is a misdirection of funds.”

Meanwhile, Ishmael Zulu from CUTS said in order to mitigate the impact of the pandemic on the people, the government should reduce the income tax rates.

“We recommend that the government must reduce income tax rates at the different ratios. As a result of the COVID-19, many people’s incomes have been affected, have been reduced, have been cut and one of the ways to mitigate this challenge is to reduce income tax rates at different rations. Secondly, to mobilize resources from partners for different social protection and increasing social cash transfer to several vulnerable groups, both in rural and urban areas. Thirdly, to reach out to bilateral and multilateral partners for support and temporary suspension of debt interest repayments,” said Zulu.

“How much Zambia is paying in terms of debt repayments collectively alongside the government’s wage bill accounts for over 90 per cent of domestic resource spending. And this leaves less than 10 per cent for spending in all other sectors. Zambia’s external debt currently stands at about US $11.2 billion. Of that amount, commercial debt accounts for around US $5.6 billion. And with commercial debt, it’s quite difficult to negotiate delayed payment.”