Zambia’s economic growth rate could drop to below two per cent this year, triggered by a cocktail of challenges, including constrained electricity generation and lower than anticipated mining output, says Bank of Zambia (BoZ) governor Dr Denny Kalyalya.

And Dr Kalyalya has defended the Monetary Policy Committee’s (MPC) decision to drastically hike the Monetary Policy Rate (MPR) by 125 basis points to 11.5 per cent as a necessary move to arrest Zambia’s escalating inflation and prevent a full-blown economic implosion.

Meanwhile, Dr Kalyalya says the kwacha’s sharp depreciation earlier this month was compounded by the emergency electricity imports and increased demand for petroleum products, amidst Zambia’s huge power deficit.

Speaking during a media briefing to announce the MPR in Lusaka, Wednesday, Dr Kalyalya said the country’s GDP could drop to below two per cent, with growth prospects expected to remain weak and subdued going into the New Year.

“What we have seen is that there has been this downward revision from 2.3 per cent to 2.0 per cent. And if things don’t pick up, we may end the year (2019) at less than two per cent, that’s very low! It calls for us to reflect and figure what we may need to do. We can’t continue to do the same thing, we must question our actions, that’s what we are calling attention to,” Dr Kalyalya told journalists.

“If you look over the past five years, 4.7 per cent, that’s the average, so we are growing below. That should be a concern to all of us. We must figure out what is it that we must do to ensure that growth starts to pick up.”

A contraction in mining output, construction, transport and storage accounted for the slowdown in real GDP growth, BoZ data shows.

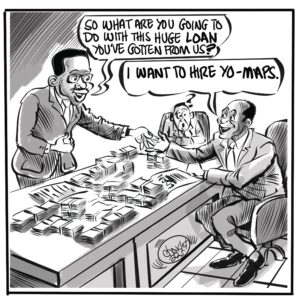

Dr Kalyalya outlined that domestic credit drastically shrunk during the third quarter ending September 30 to 10.1 per cent from 20 per cent in June, 2019, due to lower growth in lending across all sectors of the economy.

Money supply in the local economy equally contracted to six per cent year-on-year, according to BoZ data.

“In the case of domestic credit, what we are saying is that growth declined to 10.1 per cent, year-on-year. If credit is slowing down, it shouldn’t be surprising you that growth is also going slow. Money supply: with the credit going down, it’s not surprising that money supply didn’t grow because these go hand-in-hand; if there’s not much economic activity, money supply is also reduced,” he added.

And he defended the hike in the MPR by 125 basis points to 11.50 per cent from 10.25 per cent as a necessary move to arrest Zambia’s escalating inflation and prevent a full-blown economic implosion.

“If we don’t do what we are doing (hiking the MPR), this is unlikely to change. If anything, we’ll be caught up into a situation where we may have what what we may term as ‘stag inflation’ where we have stagnancy, but inflation is going up, which is a very, very difficult situation to come out of so, we don’t want to get to that,” Dr Kalyalya said.

“I want to assure you that the decision point is a difficult one because we are mindful of the impact of whatever decision that we come up with. So, we take a careful look at what is going on in the economy and we try to do this over a period of two years, which is eight quarters. It (rate hike) may seem harsh, but it’s because the conditions are quite tough, and we have to rise up to the occasion to ensure that things don’t spin out of control because, then, we’ll be forced into making haphazard decisions. In particular, we noted that the projections over the horizons were indicating that inflation will remain outside the target (6-8 per cent) range. The adjustment of 11.5 per cent by itself will be able to bring able to bring inflation back in the corridor.”

Meanwhile, Dr Kalyalya explained that the kwacha’s sharp depreciation earlier this month was compounded by the emergency electricity imports and increased demand for petroleum products, amidst Zambia’s huge power deficit, which had leaped to 872 megawatts.

“When we came to November (2019), things changed; the kwacha came under severe pressure such that it moved quite quickly to K14 per dollar. With constant load-shedding, there was a lot more use of fuel, there continued to be pressure. Then, there was the issue of imports of fertilizer; then, there was this announcement that Zesco would also be importing (electricity). When that came in, it just hastened the pressures that were already in the market, that’s how we see the kwacha losing a lot of value,” explained Dr Kalyalya.