BANKERS Association of Zambia (BAZ) chief executive officer Leonard Mwanza has called on individuals holding on to cash outside the banking system to deposit the money in order to help boost the volume of cash in circulation.

On Saturday, the Bank of Zambia said there was an unprecedented rise in the demand for cash countrywide during the past few months which had led to the shortage of banknotes and coins.

And speaking on the Hot Fm Breakfast show, Monday, Mwanza noted that there was a low volume of cash in circulation as a lot of money had gone out of the banking system.

“There were interventions by the Central Bank starting last Friday, so there will be a gradual way of ensuring that we improve the quality of notes and supply. So, over the weekend we saw a bit of normalcy on the ATMs and we do have that assurance from the regulator going forward, we will be getting the necessary support. The biggest call is that those holding cash outside the banking system, our appeal, let them bring it back to us and deposit that cash so that it can help to boost up the volume of cash in circulation. Right now, it is quite low, most of the money has gone out of the banking system,” he said.

Mwanza further expressed concern at the recent demand for cash when digital channels were active and operating.

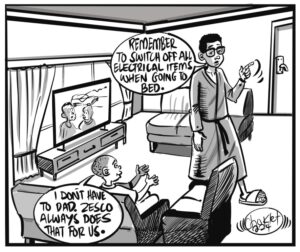

“There was a break in the cycle because cash was just going out and not coming in. In overtime that is what has caused this shortage. We have always advocated for a cash-lite economy, meaning we need to migrate towards embracing digital payment platforms. It was a bit surprising that during the same period when most of the digital channels were extremely active and efficiently operating, we saw, on the other hand, this huge appetite for cash and yet alternative channels we have the online banking operating smoothly, the EFT are working smoothly, the mobile payments are working smoothly and the figures are quite impressive in terms of the numbers. So, it became a bit worrying why people were more inclined to have cash in hand instead of utilizing the digital channels that have been working very perfectly and efficiently,” he said.

When asked why smaller notes were usually loaded by banks at month-ends, Mwanza said banks only load cash notes which were available to them.

“It depends on what is available. So, when banks request for money from the Central Bank and if they receive K20s, that is what they can load. If they receive K50s, that is what they can load. If they receive K100s, that is what they can load. The nature of month-ends, there is high demand for cash so you might find that when people are drawing out their salaries, they get K100s, K50s but over that cycle, you will end up finding a situation where the high denomination notes are in short supply. It is at that point where banks have to load what is available,” said Mwanza.

“The solution lies in the markets, the individuals, the businesses. When they get out the cash, it is important that it is brought back into circulation. When they get this cash, they need to spend it so that it can come back into circulation. Cash is about what is available. The only thing we can advise is that if you really want to pay for something why not use your card, why not use your online payment? Why not use your online payment? Why not use your mobile payment? Those options are available. So, we don’t really need to carry huge sums of cash and then you pay a retailer. We can help to improve the quality of cash in circulation if we all embrace digital channels.”