FINANCE Minister Dr Bwalya Ng’andu has disclosed that over K390 million was taken off Zamtel’s balance sheet after restructuring through a debt to equity swap with its subsidiary, Infratel.

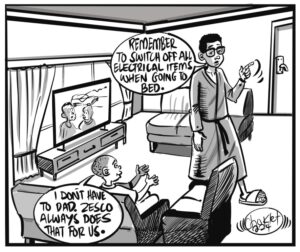

And Dr Ng’andu says ZSIC General Insurance, Nitrogen Chemicals Zambia and Zesco are also scheduled for balance sheet restructuring.

Meanwhile, the minister says loss making public entities need to be restructured first before they can attract equity investments from the public.

Dr Ng’andu was speaking in Parliament, Wednesday, in response to a question for oral answer by Kantanshi Independent member of parliament Anthony Mumba who wanted to know how many companies were under the Industrial Development Corporation and how many were loss making and what measures the Group was putting in place to help the struggling parastatals.

Mumba also asked the minister the number of jobs created by the IDC created as at March 2019 and what measures the government is taking to accelerate job creation under the Group.

In response, Dr Ngandu said 12 companies in the IDC Group made losses as at end of 2018, an improvement from the 25 that made losses in 2016.

He said balance sheet and organisational restructuring were among measures implemented, with Zamtel being one of those covered as K390 million was taken off its books.

“As at 31st December 2018, 12 companies in the IDC group of companies recorded losses. In contrast, 25 companies made losses in 2016, representing over 100 percent improvement in the performance of the companies in the group. Madam speaker, IDC has been implementing various interventions to turn around the loss making companies and these include, one, recapitalization through shareholder loans. From 2017 to date, IDC has disbursed over K257 million in shareholder loans. Secondly, balance sheet and organizational restructuring. An example of this intervention Madam Speaker is Zamtel, were Zamtel balance sheet was successfully restructured as at 31st December 2019. Implementing this measure, over 390 million was taken off the Zamtel balance sheet through a debt to equity swap and liabilities with the passive infrastructure were transferred to a subsidiary company which is called Infratel,” Dr Ng’andu said.

“Now I need to indicate here that the business model that has been applied in the case of Zamtel is creating a new subsidiary which they are referring to as Infratel to operate the telecommunications infrastructure and provide core location services and this enables Zamtel to focus on its core business of providing service to its customers.”

He said apart from restructuring balance sheets of some companies, the IDC plans to remove non-commercially oriented companies from the IDC portfolio.

“The other companies that are earmarked for balance sheet and organization restructuring include ZSIC general insurance, Nitrogen Chemicals Zambia and Zesco. The third intervention madam speaker involves removal of companies from the IDC portfolio that are not commercially oriented. There are still companies under the IDC portfolio that are not in commercial business but their main purpose is to provide public goods. These companies will be handed to the line ministries for them to provide financial backstopping and to ensure that they continue to offer the services that they are mandated to provide in an effective way,” Dr Ng’andu added.

And in response to a question from Serenje MMD member of parliament Maxwell Kabanda on whether the loss making companies will be unbundled so that government doesn’t spend more money to sustain them, the minister said the loss making entities will first have to be restructured to make them attractive for buyers to come on board.

“Madam Speaker, I did mention at the beginning of the process, the number of companies that were loss making were 25 and this number has reduced to 12. That’s a huge improvement and what it’s pointing out to is that the task that IDC has undertaken over the time that it has taken over these companies is to make them financially strong. It is very difficult to sell a company that is loss making. You may have the desire to sell it but you won’t find anybody who is willing to buy a company that is going to be a liability from the very beginning. So if you want to make a company attractive for selling, you have to restructure it, you have to put it at a point, a level where it is attractive to buyers and I think that’s what is happening. But also another line that we have taken is to see whether some of these companies, after they have been made strong, can actually be put on the stock exchange so that they are available for ordinary Zambians to buy into and I think that’s a very attractive proposition because these companies are now becoming assets in which all Zambians can actually benefit from,” said Dr Ng’andu.

“Listing on the stock exchange; some of the companies under the IDC portfolio will be listed on the stock exchange, not only as a way of accessing capital but also to provide an opportunity for citizens to participate in the shareholding of these companies. ZSIC Life is earmarked for listing on the stock exchange and I need to mention that a few weeks ago, ZAFFICO was listed on the stock exchange.”

One Response

this is indeed the right move to take and am pleased that Zambia State Insurance has been eye marked for such an ambitious restructuring

In the first place it is my desire that ZSIC prosper in the Insurance Industry where others, like Madison and Professional Insurance re on top of things and are meeting their respective customers needs. I have been at times very disappointed with ZSIC for not paying the claims in good time and that, as a patriotic Zambian, has hurt me a lot because the said service provider dents its image to me and discourages me from not buying more policies from it.

We can only move forward with such progressive ideas