Zambia will now be paying higher interest rates when borrowing following the downgrading of its credit rating from B to B – by the Standard & Poor’s Ratings, economist Dr Lubinda Haabazoka has warned.

And Dr Haabazoka suggested that the only solution for Zambia out of the downgrade was to embark on a campaign of either restructuring its unfavourable debt or refinancing other debt to ensure that the debt service coverage ratios were favourable.

In an interview with News Diggers!, Dr Haabazoka, who is Economics Association of Zambia (EAZ) president, cautioned that lenders would now be sceptical about lending to Zambia because they would be looking at the country’s ability to meet its principle and interest payments in the long-term.

He observed that Zambia would be made to pay higher interest rates following the credit rating downgrading.

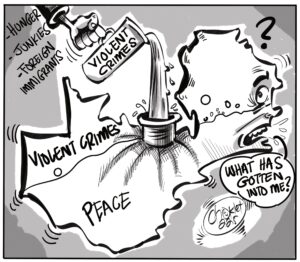

Last Friday, Standard & Poor’s Global Ratings downgraded Zambia’s long-term foreign and local currency sovereign credit ratings to ‘B -‘ from ‘B’, reflecting the country’s faster debt accumulation and higher fiscal deficits.

“The impact of the downgrading of our credit rating will be that we are now going to be able to borrow resources at higher interest rates because the rating basically signifies the risk of default. So, what the lenders are going to look at is our ability to meet our principle and interest payments in the long-term because the negativity as indicated by rating agencies are on the long-term. In the short-run, I think we expect appetite for Zambian issued debt to remain stable because in the short-run, we are able to meet our obligations. But what investors will be sceptical about is our ability to meet the already issued Eurobond. So, the only solution now is to start a campaign of either restructuring unfavourable debt where possible or refinancing other debt to ensure that our debt service coverage ratios are quite favourable, meaning we should be able to reduce the amount of money we are spending on debt service. This practice is done worldwide; the US government is one of the most prominent users of such techniques,” Dr Haabazoka said.

“I think that the news that Zambia’s sovereign credit rating has been downgraded from B to B- is quite unfortunate owing to the fact that when you look on the other factors that are used in coming up with an average rating, things like political risks, those are stable. Macroeconomic risks…the Zambian kwacha is relatively stable, inflation is in single digits and also other factors, I think they are quite strong as compared to what we are seeing in other countries, especially in Europe where, for example, Turkey is under pressure and the other different markets. But when you look at Zambia, I think we want to look at a credit risk as being one of the most contributing factors to the downgrading. I think that the rating agencies understand that in the short-term, we will be able to meet our liquidity requirements or our obligations, but they are much more scared in the long-run [in] terms of the Eurobond because there is that talk to say, ‘we need to refinance that debt.’ That’s why in order for us to keep a favourable rating, we need to put in measures to ensure that our prospects in the long-term are quite positive.”

And Dr Haabazoka suggested called for a review of existing debts that can be refinanced.

“So, I think what we need to do now is to sit down and see which debts have higher interest rates because we have financiers scattered around the world lending on the European and Western markets for as low as one to three per cent and those people are even willing to bring the money into Zambia because Zambia has been known to be a country of stable political and economic environment. We need to sit down and see which debts we can refinance now, renegotiate or restructure debt with the Chinese to ensure that pay back is extended,” Dr Haabazoka explained.

“You know, what normally happens is that if we restructure the tenure of the loans, we will pay less in terms of interest and principle payments, but in the long-run, we will pay more because we are extending the length of the tenure of the loan, but at the end of the day, we will even be able to borrow more money because what is very bad is not the amount of the loan that you have or the amount of the debt to GDP; what is bad is the amount that you are paying versus the revenue that you are raising. If we had to reduce the amount of money we are paying by half by restructuring the debt, you will find that our books will be actually more cleaner and we will have a leeway to even borrow more money.”

Meanwhile, Dr Haabazoka said cutting down on expenditure like some international money lenders were suggesting was not the only solution of solving the country’s debt crisis.

“We have a lot of finance experts, and as Economic Association of Zambia, we are able to come back to sit on the table with government and other responsible agencies and provide a home-grown solution, that is why we are very sceptical and we do not encourage government to go and borrow from the IMF because the IMF will be against any restructuring or refinancing, but will tell us to cut government expenditure. And if you cut government expenditure, for example by US $1 million, you would reduce demand in the economy by one million dollars, for example, then the economy suffers by the same one million dollars,” observed Dr Haabazoka, who is also director at the Graduate School of Business at UNZA.

“That is why cutting expenditure in some cases cannot be beneficial for the nation. So, as we cut waste in terms of government expenditure, we should not cut expenditure towards infrastructure projects because by reducing government expenditure, you are reducing demand of goods and services in the country by that same amount thereby reducing economic growth. So, there is a way we can deal with our debt by not punishing or not reducing economic growth. A clever way we can do it is actually sit down and do that and you will see that even our ratings will grow after the restructuring and refinancing of our debt.”