MAAMBA Collieries Limited has admitted that ZCCM Investment Holdings Plc advanced it US$10 million as a loan to enable it meet its obligations to settle its creditors.

It, however, added that this was at the request and instance of the Industrial Development Corporation Limited (IDC), which was tasked by the Ministry of Finance and National Development to procure funds for Zesco Limited to settle its indebtedness to it (Maamba Collieries).

This is in a matter in which ZCCM Investment Holdings Plc has sued Maamba Collieries Limited in the Lusaka High Court demanding payment of US $10 million that the latter borrowed to enable it meet its obligation to its creditors.

ZCCM lamented that as a result of Maamba Collieries’ failure to repay the loan advance, it had suffered loss of use of its monies.

It stated in its statement of claim that Maamba Collieries Limited was a company operating and running Maamba Coal Mine and Thermal Power Plant in Maamba, Southern Province.

ZCCM further stated that in March, last year, it entered into an oral agreement with Maamba Collieries for the advance of US $10 million to Maamba Collieries to enable it meet its obligations to its creditors.

“It was a term of the agreement as set out in the defendant’s letter of March 20, 2019, that the defendant would repay the loan advance from its power sales, but not later than 60 days from disbursement. On or about March 25, 2019, in pursuance of the said oral agreement and letter of March 20, 2019, from the defendant to the plaintiff, the plaintiff advanced the said US $10 million to the defendant,” read the statement of claim.

ZCCM stated that despite the 60-day period committed to pay lapsing, Maamba Collieries did not and has not repaid the loan advance.

In its defence, Maamba Collieries admitted that ZCCM advanced it US $10 million, but added that it was “at the request and instance of IDC, which was tasked by the Ministry of Finance and National Development to procure funds for Zesco Limited to settle its indebtedness to Maamba, which exposure was causing imminent default on the part of Maamba with its diverse financing agreement.”

It stated that after disbursement of the funds, ZCCM sent it a term sheet and an agreement called “Liquidity Support Agreement” in respect of the advance, which provide, inter alia, that the sum of US $10 million would be repaid by Maamba Collieries within seven days of receipt by it of bulk payment, from its debtor Zesco Limited.

Maamba Collieries stated that in both its letters dated March 20, 2019, and the term sheet, repayment of US $10 million to ZCCM was conditional on receipt by it (Maamba Collieries) from Zesco Limited, which payment had not been received to-date.

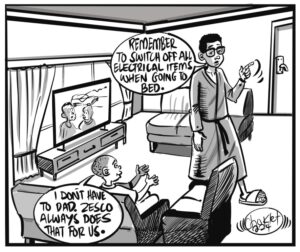

“Alternatively, the defendant (Maamba Collieries) shall seek indemnity from third-party Zesco Limited, which currently owes the defendant the sum of $232,000,000,” stated Maamba Collieries.