AN investigation has revealed that a company belonging to Speaker of National Assembly Dr Patrick Matibini paid K100, 000 (about US$5,000) for eight plots worth K21 million (US$994,000) at the Lusaka South Multi Facility Economic Zone (MFEZ).

When contacted to explain how Mishikili Properties Development Limited got the land in question, Speaker Matibini who is the company executive chairman declined to comment and directed MFEZ management to respond to a News Diggers Query, saying the Speakers’ office does not respond to the media.

And responding on behalf of Matibini, MFEZ acting managing director Kennedy Mwila confirmed that the Speaker’s company only paid K100,000 but claimed that the land in question was re-evaluated and priced at K4.4 million, adding that the Speaker’s company was owing K4.3 million which is expected to be paid by June 2022.

According to a News Diggers investigation, on 10th August 2018, the Managing Director for Lusaka South MFEZ approved the sale of eight residential plots to Mashikili Property Development Limited at a total cost of K100,000 contrary to the approved selling price of K100 per square metre and K570 per metre plus K50 as service fees.

In a letter dated 10th August 2018, the Managing Director of LS MFEZ wrote to Speaker Matibini as the Executive Chairman of Mashikili Property Development the approval of Mashikili’s application and the conditions under which Mashikili Property Development was going to execute the payments. However, a scrutiny of the schedule of residential plots revealed that the actual selling price for the plots was several times higher.

The investigation further revealed that that basis upon which the eight plots were sold for K100, 000 could not be established as the approved selling price by the Chairperson who was acting on behalf of the full board which was yet to be put in place, approved the selling price of K100 per square meter (for individuals) and K570 per square meter (for Companies) plus K50 service fee.

It was also revealed that the sale took place in August 2018 before the selling price was approved, as approval for the selling price was done on 10th September 2018.

When the Auditor General audited Lusaka South MFEZ, it was discovered that, although there was acknowledgement for confirmation of payment of K100, 000 for the said properties by the buyer, the payment could not be confirmed as the funds did not reflect in the cash books of the two bank accounts maintained by the MFEZ.

“This resulted in loss of revenue through undervalued sale of plots, loss of revenue through fraudulent activities and misappropriation of company assets,” wrote the Auditor General in the preliminary report of the facility in 2019.

Responding to a press query from News Diggers, Mwila said MFEZ expected the Speaker’s company to pay US$994,000, but the amount was reduced to K100, 000 and after the money was paid, the value of the land was hiked to K4.4 million.

Below is the press query sent to Mishikili Properties Development Limited executive chairman Dr Matibini, which MFEZ responded on his behalf.

The Lusaka South Multi-Faciliry Economic Zone Limited is in receipt of a Press Query that your media house sent to the Honorable Mr Speaker, Mr Justice, Dr. Patrick Matibini SC, BA, FIArb, MP. As the office of Mr Speaker does not respond to media queries, we have been forwarded your query in our capacity as transaction holders, and are glad to provide responses on his behalf. Below are the responses to your questions,

Question: What was the value of each of the eight plots in question?

Answer: Initially, on 30. May, 2017, the price of the plots we computed as follows:

Link Houses Stands

Area 2.3124 ha 23124m²

Price: $43 per square meter

2.3124 ha = $994,332,00

Total Area = 2.3124 ha

Total Price = $994,332.00

And accordingly, Mashikili Property Development Limited, was required to settle the sum of USD 994,332.00. Subsequently, on 10 August 2018, the purchase prices were revised downwards to a total sum of K100,000.00 for the land. And the said sum of K100,000.00 was accordingly paid by Mashikili Property Development Limited on 29 August 2018. However, on 8 November, 2019, the offer of 10th August 2018, was revisited and corrected following a land valuation conducted during the period and approval of new land prices by the Board on September 10,2018.

Accordingly, a revised offer rescinding the contract in force, and demanding settlement of the sum of 4,478,000.00 was communicated to Mashikili Property Development Limited. On 24th January, 2020, Mashikili Property Development Limited, duly accepted to settle the revised contract sum of K4,478,000.00, within a period of 24 months from the date of the revised contract. It is noteworthy that Mashikili Property Development Limited, agreed to the revision of the contract sum, notwithstanding that the initial contract of sale had been duly concluded.

On 30th June, 2020, LS MFEZ communicated the revised offer on new terms. And in response, Mashikili Property Development Limited, undertook to settle the sum of K4,478,000.00, within a period of 24 months, effective 1. July 2020. That is, on or before 30 June, 2022. As of now, the parcels of land in question, are still owned by LS MFEZ, until the outstanding balance is settled within the stipulated period. Consequently, LS MFEZ Limited, reserves the right to repossess the land from Mashikili Property Development Limited, in the event that the full payment for the parcels is not made within the stipulated period.

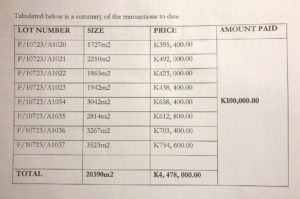

Tabulated below is a summary of the transactions to date

Q. How much did Mashikili Property Development Limited pay in total for the eight plots?

Mashikili Property Development Limited has to far paid KI00, 000.00 and has a balance of K4, 378, 000.00 to be paid by June 30, 2022, because the revised offer letter to the company issued on 30th June, 2020, allowed a payment period of 24 months from the date of acceptance and is still in force.

5. Who approved the sale of the said plots?

Approval of sale of plots to Mashikili Property Development Limited was granted by the Board of Directors of the LS MFEZ Limited at its Board Meeting held on January 20, 2017.

6. How was the approval done in August 2018, when the MFEZ Board approved the selling price on September 10, 2018? As stated above, the approval to sale land to Mashikili Property Development Limited was granted by the Board on January 20, 2017 and not August 2018, as suggested by your press query. However, the land survey and valuation exercise that followed necessitated the adjustment in prices of the surveyed plots, in line with new land values. Therefore, the selling prices approved by the Board on September 10, 2018, were in order, and authenticated the re-offer at new prices to, among others, Mashikili Property Development Limited.

News Diggers then wrote back to MFEZ, asking them to explain how land valued at US$994,000 could be discounted to K100,000.

Below are the responses to the follow up questions.

Question. How did MFEZ arrive at the 99.5% discount (From US$994,000 to K100,000 Kwacha)? Who approved this discount?

Answer: On 29th June 2015, Mashikili Property Development Limited made an inquiry on the then Management of LS MFEZ Limited on the availability of land for both residential and commercial developments. Following the said inquiry, land for Mashikili was identified in 2015, and offered at USD43 per square which price related to industrial land, and not residential. Consequently, the price was revised downwards to K100,000 for the block of land which was not yet surveyed. The Lusaka South Multi Facility Economic Zone Limited, later undertook an exercise to plan and survey all its land, following which the land was later revised to reflect market values. In view of the above, the said K100,000 cannot therefore be properly construed as a discount; it was not.

Q. Was there valuation done on the said plots before they were offered at the initial K100,000 purchase price to Mashikili Properties?

A. As stated in 1 above, The Lusaka South Multi Facility Economic Zone Limited, undertook an exercise to plan and survey its land sometime in 2018. Land prices were therefore only reviewed after the valuation of 2018, following which all land sales were based on the new values.

Q. Which Company or individual paid the K100,000 for this transaction on behalf of Mashikili Properties?

A. Our records indicate that Mashikili Property Development Limited, made the payment of K100,000.00 on its own behalf, on August 29, 2018, and this amount was confirmed on August 30, 2018.

Q. How many other individuals or Companies were given such a discount from US$994,000 to K100,000 and what is the status of those transaction? Can MFEZ name at least one other company that benefited from this offer?

A. The amounts in question did not amount to a discount as stated above. All land transactions for residential plots are stated at valuation. We would like to further mention that over 60 clients have so far bought land at similar prices as Mashikili Property Development Limited Unfortunately, we owe our investors confidentiality, and would not divulge names of any particular buyers without their consent.

Q. Is it part of the LS MFEZ investment guidelines to sell land at 2.2 percent down payment with full settlement period of 24 months, interest free?

A. Our terms of payment still remain settlement within 24 months. The 2.2% referred to, amounting to K100,000.00 did not amount to a down payment, as it related to an initial transaction which was fully paid for, and subsequently rescinded, and revised. As regards the question of interest, we are guided by the Law Association of Zambia General Conditions of Sale, 2018. As a result, interest payment has not arisen, because there has not been default of the agreement.

Q. Are there still plots available at MFEZ today valued at K550,000 each which citizens can get after paying 2.2per cent down payment.

A. Plots available at the LS MFEZ Limited are sold at the revised prices ranging from K100 – K250 per square meter. Clients therefore, are free to procure parcel(s) suitable to their needs. We reiterate that payment for our residential plots is within 24 months. However, if our clients are inclined to settle the purchase price within a shorter period of time, they are at liberty to do so.

Q. Why did this transaction not appear in the Auditor General’s report when in fact the auditors on the ground raised this query with LSMFEZ Limited Management?

A. The audit query did not appear in the Auditor General’s report, because the queries were adequately addressed, and responded to.

One Response

This country is corrupt to the core. Until we can find some leadership, we are doomed.