GOVERNMENT still needs to clearly define their level of political will required to achieve the Economic Recovery Plan’s (ERP) objectives and attract a much-needed International Monetary Fund (IMF) bailout programme, says economist Chibamba Kanyama.

And Kanyama says introducing ground-breaking economic reforms can be suicidal on government’s part given Zambia’s current economic crisis.

In an interview, Monday, Kanyama observed that government still needed to demonstrate their level of coordination required among the various government agencies to actualise the ERP’s objective of reviving growth as previous economic recovery plans failed owing to lack of political will.

He cautioned that an ERP without real political will to address Zambia’s fiscal crisis will not be enough to clinch the much-desired IMF bailout package for balance of payments support.

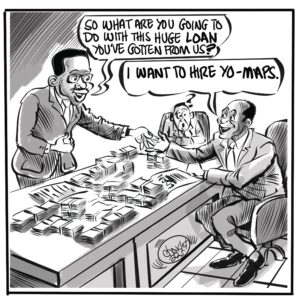

“The authorities will need to tweak the newly-launched Economic Recovery Programme so that it aligns to the expectations of the International Monetary Fund for a possible programme. While the ERP clearly and elaborately outlines government intentions to put the country on a healthy growth path, it still needs to be enhanced by: 1. Defining the level of political will required to drive the necessary changes. This is because Zambia has had similar plans before, but failed to drive growth because political will was in some cases lacking and hence the high debt levels we are currently experiencing. It is very difficult to drive significant reforms when there is a conflict between the desire for fiscal discipline on one hand, and the appetite to borrow to finance projects and consumption on the other. 2. The ERP should also clearly demonstrate the level of coordination required among the various government agencies so that investors, including the IMF, do not take the ERP as just an intention without commitment,” Kanyama advised.

“The level of inter-departmental accountability in driving the various initiatives is extremely high. Some investors, who e-mailed me, already argued that the number of initiatives is just too many to be administered within a four-year period, more so that 2020 is already gone. Others have further argued that the ERP is not speaking into the 2021 national budget in many areas; will the budget be tweaked to answer to the ERP, especially in the area of addressing the financing gaps? 3. I also feel the ERP incorporates swift and ground-breaking reforms that will make it easier for the IMF to engage. The ‘elephant in the house’ are the external debts and these should have attracted tough fiscal management measures beyond what we have read before.”

And Kanyama said that introducing ground-breaking economic reforms to accelerate the prospects of an IMF package could be suicidal on government’s part due to their inability to implement policy plans.

“The IMF will expect measurable commitments in addressing subsidies given to fuel, energy, agriculture and others. They may also expect a sealing in expansion of wages for the public sector, demonstrate evidence of project cancellation, re-scoping, as well as the postponement of loans; realignment of the ERP to 2021 budget; bringing forward the debt reprofiling to before mid-2021 from the projected end of 2022; deal with external arrears in 2021 when we plan to engage the Fund and not end-2023); demonstrate transparency and accountability in social safety nets. I am personally not in favour of introducing additional austerity measures, such as a freeze in wage growth, because Zambians have endured too much and will continue to endure more pain as the kwacha continues to depreciate against other currencies and the inflation rate remains high,” he said.

“However, your question to me is whether the ERP is sound enough to attract the IMF and the answer is that the IMF is expecting more! This is where it calls for political will because introducing ground-breaking economic reforms to attract the IMF, given where we are as a country, can be suicidal on the part of the sitting government. To fully recover the economy implies biting the bullet like we did between 1991 and 1995. We know the repercussions associated with those policy reforms; hundreds of thousands paid the price through job losses just to bring the economy to recovery. Are we ready to go through that path again? This is where political authorities come in and that is also what the IMF is expecting: cut-throat measures that may affect many people.”

He emphasised that the Fund would not embark on a programme without clearly defined frameworks to implement the ERP.

“The only consolation is that the IMF has in the past few years changed its engagement strategy before introducing a programme: First, allow the individual countries to request a programme and possibly drive it as we now have with the ERP and the Zambia Plus, its predecessor. Second, IMF now engages widely with broader stakeholders for reasons of policy traction, empowerment and accountability. Third, as much as the programme measures can be tough on citizens, the IMF will not embark on a programme without clearly defined framework supporting a social safety net,” said Kanyama.

“The goal in the ERP should be to ensure our intentions are consistent and speak with each other. Above all, there must be extensive change management training in the public service. In order to have different results for any strategy, there is need for clear leadership at every administrative level. The ERP will be the same old story unless we learn the power of efficiency. Finally, and if we really need the support of the IMF as projected on the last line in Table 1 on page 11, let us translate the ERP from a narrative to actual projected figures showing clearly what each action will produce quantitatively.”

Last Thursday, President Edgar Lungu launched the unprecedented ERP for the period 2020-2023 at a ground-breaking ceremony in Lusaka, which will set the tone for the Medium-Term Expenditure Framework (MTEF), replacing the Economic Growth Stabilisation Programme, popularly known as ‘Zambia Plus’ 2017-2019.

The ERP seeks to restore microeconomic stability, attain fiscal and debt sustainability, restore growth, dismantle domestic arrears and safeguard social sector spending.

Zambia became the first African country to default on its sovereign debt following non-payment of a US $42.5 million Eurobond coupon interest repayment last month since the outbreak of the Coronavirus.