Africa Confidential says Zambia risks losing its sovereignty to China as that country will seize national assets once government defaults on loans.

And Africa Confidential has revealed that Britain’s Department for International Development is investigating three ministries for fraud.

Meanwhile, Africa Confidential has noted that government continues to spend lavishly despite Zambia being in debt distress.

In a report titled ‘Bonds, bills and ever bigger debts’ published on September 3, Africa Confidential observed that fraud in government institutions was of concern to donors.

“Financial management across the ministries is under scrutiny. Britain’s Department for International Development (DFID) is investigating fraud in three ministries, which could have serious implications for future funding, Africa Confidential has learned. And Zambian exposure to Chinese debt, especially project credit, is still causing concern,” read the report.

ZNBC was already being run by the Chinese and disclosed that Zesco was also already in talks about a takeover by a Chinese company.

“A major worry of the IMF and US is that China’s BRI strategy is first to encourage indebtedness, and then to take over strategic national assets when debtors default on repayments. The state electricity company Zesco is already in talks about a takeover by a Chinese company, AC (Africa Confidential) has learned. The state-owned TV and radio news channel ZNBC is already Chinese-owned. The long-term outcome could be effective Chinese ownership of the commanding heights of the economy and potentially the biggest loss of national sovereignty since independence,” the report read.

Africa Confidential noted that Zambians would be alarmed to learn the real Chinese debt figures.

“Zambia is a good example of what the International Monetary Fund and the United States Senate are calling a crisis of accelerating developing-country indebtedness to China. On 3 August, a bipartisan letter by prominent US Senators to US Treasury Secretary Steve Mnuchin urged the US not to allow the IMF to bail out countries which had gotten themselves into financial difficulties thanks to over-exposure to Chinese debt, especially for ‘overpriced’ infrastructure projects. The démarche builds on the concern expressed by IMF Managing Director Christine Lagarde in a major speech in April and pundits in Lusaka say the description fits Zambia like a glove,” the report read.

“The Senators’ letter names ‘predatory Chinese infrastructure financing’ as part of ‘debt-trap diplomacy’ which is integral to the Belt Road Initiative (BRI). Twenty three of the 68 developing countries, the letter continues, are in debt distress or strong risk thereof because of the BRI. Although Zambia is classified as at high risk of debt distress it is not among the 23 named, but Africa Confidential’s sources say this is only because much of its debt to China has not been fully accounted for, an exercise the Lusaka exchequer is not anxious to complete for fear of the alarm the figures would cause.”

Africa Confidential noted that although Finance Minister Margaret Mwanakatwe announced that all Chinese projects below 80 per cent completion would be halted, President Edgar Lungu told Chinese nationals that all projects would go ahead as planned.

“The Zambian government is supposed to be contributing 15% of its own money to the Chinese-financed projects. Meeting this commitment is testing government finances to the limit and taking precedence over social expenditure. Even though Finance Minister Margaret Mwanakatwe pledged to halt all Chinese-backed projects that were less than 80% complete, on 11 July President Lungu publicly told Chinese officials in Lusaka that there would be ‘no disruption in the ongoing projects’ financed by China,” read the report.

“Since President Edgar Lungu came to power, Zambia has signed off on at least US$8 billion in Chinese project finance. Over US$5 billion of this has not been added to the total because Zambia insists the money has not been disbursed, and more large loans are in the pipeline. Yet the finance ministry does not have the capacity, insiders say, to police, let alone stem, all the spending. In some cases, the financial penalties for halting disbursement on projects would outweigh the savings. Donor governments have offered technical assistance to bring the project debt mountain under control but have been rebuffed.”

Africa Confidential also reported that IMF representative Alfredo Baldini was asked to leave on accusations that he was “spreading negative talk”.

“The government has all but expelled an IMF official, as the debt continues to spiral and the role of Chinese projects in it raises more concern. Having allocated US$500 million to external debt service this year, the government’s liquidity crisis drags on as relations with donors and international financial institutions plummet. Lusaka asked the International Monetary Fund to withdraw its resident representative Alfredo Baldini on the grounds that he was supposedly ‘spreading negative talk’ among the donors, a source in Lusaka said. The rift is a blow to any chance – practically non-existent though it already was – of a deal,” read the report.

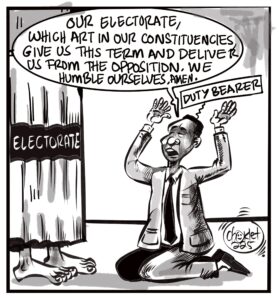

Meanwhile, Africa Confidential noted that government had continued spending lavishly despite the country being in debt distress.

“In mid-July Lusaka announced a supplementary budget of K7.2 billion (US$721 million.). Half of this is for debt service, which leaves only just enough only for public sector salaries, which it is struggling to pay. It missed most August salary payments, causing outcry among civil servants last week. Efforts to raise capital domestically are not going well. The auctions of Treasury Bills have been poorly subscribed on average although it has been using massive inducements to attract the banks. Government data shows that by the end of May it had spent US$489 million on external debt service and on 19 July it announced a further US$161.3 million was paid in June. It will need a further US$360 million over and above the sum originally budgeted to cover debt service,” read the report.

“Ministry of Finance insiders say that domestic measures now in train to re-allocate spending are not realistic and that at least another $300 million needs to come from fresh borrowing. Yet the government is spending as freely as ever, as in the lavish expenditure by the Patriotic Front on the election of Miles Sampa as mayor of Lusaka on 26 July, even though only 15% of voters turned out.”