Economist Chibamba Kanyama says Zambia has the capacity to double its projected tax collections of K41 billion in the year 2018 if there is full compliance from all tax payers.

Kanyama said this in a statement to News Diggers today, noting that a number of companies had been using creative accounting and other tax avoidance strategies for purposes of balancing their books following the economic crisis that the country was faced with in 2015.

He observed that since the crisis, a number of companies had lost growth momentum and were failing to declare meaningful returns on investment to their shareholders following the economic crisis which resulted into power outages, slump in copper prices, rising labour costs, low market liquidity and rapid depreciation of the Kwacha.

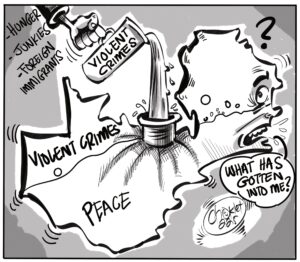

“Tax evasion is not new to Zambia but appears to have taken a completely new twist following the 2015 economic crisis the country faced. A number of companies lost growth momentum, failing to declare meaningful return on investment to their shareholders and following the marginal economic recovery this year, most of them are using creative accounting, tax avoidance strategies and to a large extent, wanton tax evasion for purposes of balancing their books. This has come at huge cost to government that equally seeks to reduce its deficit, threateningly high debt stock while at the same time consolidating its weak fiscal position,” Kanyama stated.

“The International Monetary Fund has over the past three years advised government to rationalise its subsidy policy particularly on energy and agriculture while at the same time beefing up revenue collection, the later being the surest cure towards economic recovery. The Zambia Plus strategy equally focuses on enhancing revenue collection under its economic stabilisation and growth programme. Zambia currently has capacity to double its projected tax collections of K41 billion in 2018 if there is full compliance by eligible tax payers.

He stated that the country would be able to contribute close to about K130 billion towards the treasury from taxes alone if if broadened its tax base and enhanced compliance levels amongst tax payers.

“With fully automated tax collection systems (which is still a far cry for now), broadened tax base and tax compliance, this country can contribute close to K130 billion (or US $13 billion) towards the treasury from taxes alone. This is because our Gross Domestic Product is projected to be three times higher than currently captured. Even this amount is a drop in the ocean in view of the current needs of the economy (rising social expenditures in education, health and the social cash transfer, public investments, debt redemption). As long as tax compliance remains weak, our budget will keep relying on donor support and deficit financing from the open market,” he stated.

“The latter is very dangerous for an economy whose GDP is relatively tiny. Deficit financing by commercial borrowing leads to high interest rates and makes it difficult for the same companies to recapitalise their businesses. There must be a form of moral persuasion by market players to recognise what tax compliance does; it is about economic stability, private sector survival and profitability, creation of jobs and competitiveness [because] when a country’s GDP is high, it attracts further Foreign Direct Investment.”

Meanwhile, Kanyama urged government to be prudent in the way it applied public funds.

“It is, however, important to emphasise the importance of fiscal discipline on the part of government. The recent Auditor General’s report for 2016 shows serious misapplication of funds by public officials. There is a loose though strong relationship between tax compliance and fiscal prudence by government. Tax payers do not want to see the taxes they pay end up mismanaged. Many would rather not pay due taxes. The hard working men and women at Zambia Revenue Authority must be fully supported by their public office counterparts on management of tax revenue,” stated Kanyama.

One Response

As long as the general population see public officers misuse public funds, they will not be willing to pay their taxes. Who would want to do that knowing the money they contribute is going to private hands? Similarly, the corruption perception among national leaders is a deterrent to institutions and individuals to pay their taxes. Prudence in the use of public funds, transparency, accountability and zero tolerance to corruption are the primary prescriptions to engendering public confidence and stimulating interest in tax compliance. True, broadening of the tax base in needed. It is not fair for only a few formal institutions and workers to pay tax when many of those hustling out their mint millions but do not pay tax – for them, gross income equals net income. Something needs to be done. In fact my thinking is that if compliance is high and the tax base is broad enough, the possibility for lower taxes is possible. At the moment, the few that pay tax are squeezed for more which makes them to find ways of avoiding tax payments. A sober and more realistic solution is needed, otherwise this is a far cry.