We wish to express our views regarding the role of the Economics Association of Zambia (EAZ) to which we have been and continue to be fully paid up members. The comments attributed to the president of the Economics Association of Zambia (EAZ) on ZNBC’s Sunday Interview programme on 9th September, and extensively quoted in the News Diggers of 11th September, on the national debt once again lend credence to the argument that EAZ needs to rethink the way it conducts its business and delivers public opinions. EAZ can learn from the Law Association of Zambia, Engineering Institution of Zambia and the Zambia Institute of Chartered Accountants which are much more structured in the way they operate. There is nothing wrong in individual members giving personal opinions about matters of public interest, as long as they care to state so explicitly.

We all can have our opinions about whether the country is in debt crisis or not. Based on the data that we have seen in the public domain, the EAZ president was probably correct in characterizing the debt situation as not a crisis. And a number of his other observations were reasonable. However, it seems to us that people have taken the normative content of some of the president’s remarks to be dangerously opaque. In other words, many economists took issue with his statements mainly because of what he didn’t say. The context around how the debt numbers have been disclosed to the public over the recent past has not helped the discourse either.

What is not debatable is that many economists and other citizens are leery of unrestrained borrowing and uneconomical public spending. They are concerned that our economy is not growing at a fast enough rate to enable us repay the debt, and is perhaps steadily outrunning our willingness to be taxed. The recent strife from civil society, academia and others, over the national health insurance law and other recent tax measures illustrate this point. It is plausible that stronger economic growth will eventually rescue us from crippling debt servicing obligations by providing the extra income to repay our debt. And of course, greater economic growth buoys confidence in the economy and expands the tax base from which more revenue can be generated to repay debt. However, it is equally plausible that slow growth will persist and imperil our current economic situation. From past experience, we do know that austerity will forerun sluggish growth, initially at least, given the draconian expenditure cuts and new taxes that it comes with. Either way, harder choices have to be made in order to ensure that our national debt does not grow at a rate faster than the economy can afford to repay.

What is also not in dispute is that eventually, ever-increasing debt will cause interest rates to rise, and the portion of domestic revenue that goes to servicing the growing debt will take a toll on the ability of the government to provide services and expand economic opportunities. We know that the impact of debt servicing on the operational budget is already extensive as most government programmes are underfunded because 30% of our national revenue is going to debt servicing while over 60% goes to personnel emoluments. We are spending more on servicing debt than we are spending on education and health sectors combined. This situation may not rise to a level of a crisis, but it paints a potentially perilous scenario for the future.

It is hard to overstate the importance of growth in the real sector of the economy. Should our current account deficits persist for a while, we surely will need changes to the real sector of the economy if we are to earn the foreign exchange we need to repay external debt. And rather than reduce the debate to whether our gross external debt stock as a portion of GDP passes some arbitrary threshold, we should also consider our economy’s future export potential and ability to cope with exchange rate risks?

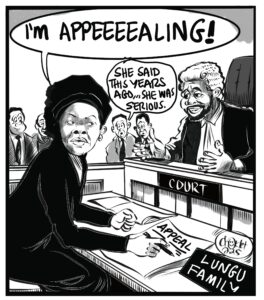

Debt restructuring is one option on the table, as the EAZ president rightly said. We think that restructuring our national debt is not avoidable, it is inevitable. But the story does not end there. At what financial and economic cost are we refinancing? Are we willing and able to simultaneously deal with the root causes? What is the intellectual integrity of our debt sustainability strategy? There is a host of issues to ponder. But, it must be emphasized that measures that only postpone but do not reduce scheduled debt payments will not restore market confidence. The consequences on our currency can be devastating. Hence, no amount of debt restructuring (in lay terms, postponing problems about the future to the future) without solving the fundamental causes in high unrestrained expenditure growth will not get us out of this problem. To advocate more borrowing without talking about these issues is not prudent. It is not surprising that EAZ is being accused of offering slapdash economic policy solutions, and dismissing concerns about the adverse effects of evidently rising public debt on our economy as scare talk. In addition, debt restructuring should go along with trying to get more output from current public spending in the public service system.

At the end of the day, we think that spending time talking about crisis or no crisis is counter-productive. Those who are calling a crisis can be guilty of overblowing the threat. Those who think that there is no evidence of a crisis on the horizon are guilty of an illegitimate assumption that a crisis would come with a clear forewarning. We know that most indicators of financial or economic crises have only been seen in the rearview mirror. What we urgently need are bold, binding fiscal reforms to curb expenditure growth. What the IMF and others are warning is that measures that might have been sufficient today will become inadequate in the near term the longer it takes. To state the obvious: waiting to act until the crisis is at our doorstep is going to come with much greater collateral damage.

Similarly, the idea that nationalizing mining companies will more likely return them to profitability because government experts are more competent than private sector professionals has been resoundingly discredited. Finally on this point, as we begin to debate the 2019 national budget our colleagues in the media should resist the temptation of narrowing irreducible economic issues to a simple game of simply assembling enough “friends” who are in support of a particular viewpoint. As Abraham Lincoln observed, you can fool some of the people all of the time and perhaps all of the people some of the time, but you cannot fool all of the people all of the time. In the same way, trying to regulate the debate to a politically-convenient level is myopic, and soon we will be found out. Economic facts and their ramifications, no matter how hard, must be discussed squarely.

Our second, and more fundamental, point relates to the way EAZ is conducting its business. Constructive engagement with policy makers is very important for an institution like EAZ, and we fully support that. The question though is, do members see EAZ primarily as a think tank (i.e. a scientific resource) at the disposal of its members and the general public (including government), or as a force pursuing its own objectives? If it is the former, then EAZ needs to ensure a much more open intellectual environment for its members, with sufficient room for internal scientific dissent. The institution could then use internal peer review mechanisms to ensure that its opinions are subjected to good scientific preparation. We would add that EAZ should consider itself as one, but only the only, institution that can offer opinions to government on matters of public interest, operating at arms-length. But if EAZ is primarily an advocacy (or propaganda) machine, then the openness that science requires will be supplanted with a marketing culture, in which only particular views are promulgated. Events of the past weeks seem to leave members confused about this. The public must understand that EAZ has a lot of members who do not have sufficient, or any, formal training in economics, for good or for bad. Many members are increasingly feeling that the current environment is not a healthy one in which to conduct serious discussions of how best to improve our national economic discourse. There is a real danger that EAZ could turn into what our colleagues in tort law refer to as “eggshell plaintiffs”, because a growing cohort of Association membership some of whom, lacking training in economics, are steadily cultivating a vocation in “un-intellectualism”.

Return EAZ to its core mandate: promoting scholarly-based policy debate, not eclectic populism. Or risk becoming obsolete.