MMD faction leader Felix Mutati says the Sales Tax Bill needs serious panel beating because it risks compromising revenue collection in its current form.

And Mutati says it’s high time government considered another tax amnesty in order to save struggling businesses.

Speaking at Protea Hotel Chipata where the MMD hosted a business breakfast forum for the Chipata business community and the Chipata Chamber of Commerce, Sunday, Mutati warned that Sales Tax would compromise revenue collection.

“The Sales Tax has got a greater risk to compromise revenue collection particularly for 2019 compared to fixing the administrative and system problems of VAT. The bill in its current shape requires significant panel beating. The Sales Tax is being premised on many pillars but in order for it to be workable, you have got to address three key issues in the Bill and we have an opportunity that the Bill is at the stage where we can provide input, where its available for panel beating,” Mutati said.

“We have to address through the Bill, the effects of tax on tax, the effects of inflation that can be induced because of the cascading effects of Sales Tax. The various paragraphs of exemptions discretion will create a distortion to your tax environment. Tax by its very nature should provide a level playing field, should minimize distortion in the business environment. So introducing multiple exemptions and multiple discretions creates distortions and will make compliance a challenge. It will make collection a challenge and it will create an appearance that if you are caritas and you are able to lobby effectively, you can secure an exemption, you can secure discretion.”

And observed that most businesses were struggling and called on ZRA to announce another tax amnesty in order to save them.

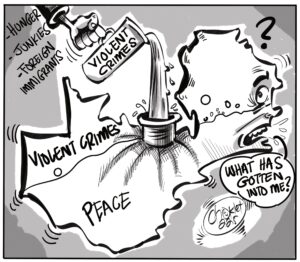

“Tax by principle is supposed to be anchored on equity and fairness. And those principles must not be compromised. So this is the injection that we need to put in the conversation of the sales tax and I think we need to give it a little bit more space to think through particularly with the challenges that we’ve got in 2019. There are urgent issues that we must attend to that are directed towards enhancement of revenue, issues around compliance in terms of revenue collection. Most businesses are having difficulties to pay their taxes. I think it’s time again that we considered an amnesty in order to create and dismantle what is owed to Zambia Revenue Authority as a basis of creating the revenue that will go to the economy to address the difficulties that we have got on one hand and on the other hand to give space to business to breathe again and be able to move forward. Business has been challenged,” said Mutati.

Meanwhile, Caritas Chipata governance coordinator John Zulu wondered why MMD had failed to use its “old magic” to improve poor farmers’ standards of living whilst in an alliance with PF.

“For us as Caritas Zambia, when we go to rural areas, the poor farmers are pointing at things [like] ‘I bought this car during MMD rule, I bought this plough during MMD rule, I built this ho during MMD rule’ meaning that it is an indication that during the MMD regime, the poor farmers were actually benefiting from their agricultural activities. This is the indication that is coming through. Now that you are working with the ruling party now, our worry or our concern is that why is it not that the same magic that you did when you were in power to allow the farmers to benefit from the agricultural practices, they can still benefit now? You will agree with me that it was only yesterday that His Excellency the President of the Republic of Zambia was directing FRA and the Ministry of Finance to pay farmers who sold crops to FRA last year and up to now they have not been paid. How do they benefit like that?” Zulu asked.

He also urged law makers to ensure there was more consultation when passing laws as well as when adopting policies.

“The other thing is that we feel that as a country we need to do more consultations when we are passing legislations and other policies relating to how taxes are going to be adopted and implemented. We feels that as much as we have a number of taxes introduced, at the end of the day, these taxes are actually being paid by the last consumer which is a poor person,” said Zulu.